Are you tired of wondering where your money goes each month? Do you dream of achieving your financial goals but feel lost on how to get there? The solution might be simpler than you think: expense tracking. Many people avoid it, thinking it’s tedious or restrictive. However, consistently monitoring your spending is a powerful tool that can revolutionize your financial life. It’s not about deprivation; it’s about awareness and informed decision-making. Think of it as installing a high-capacity (think gb!) data logger on your financial life, providing insights you never knew existed.

Key Takeaways:

- Expense tracking provides a clear picture of where your money is going, highlighting spending habits and potential areas for savings.

- By monitoring your expenses, you can create more realistic and effective budgets that align with your financial goals.

- Consistent expense tracking empowers you to identify and eliminate wasteful spending, freeing up money for investments or paying down debt.

- Understanding your spending habits can help you make informed financial decisions and achieve long-term financial security.

Understanding the Benefits of Expense Tracking

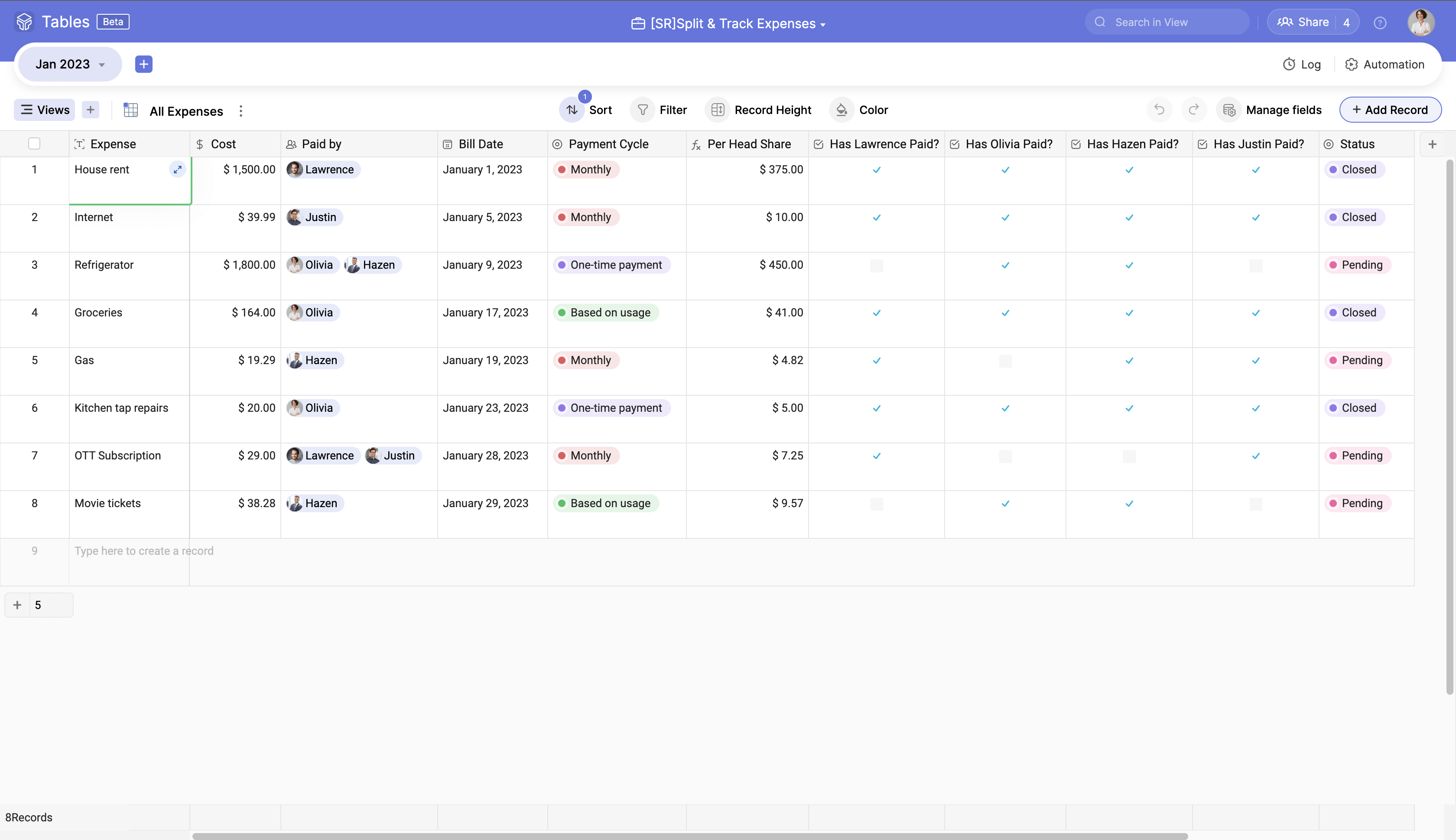

At its core, expense tracking is the process of recording every penny you spend. This can be done manually with a notebook and pen, using a spreadsheet program like Microsoft Excel or Google Sheets, or through various budgeting apps designed for smartphones and computers. The method you choose is less important than the consistency with which you track.

The real magic of expense tracking lies in the insights it provides. When you have a clear record of your spending, you can easily identify where your money is going each month. Are you surprised by how much you spend on eating out? Do you realize you’re paying for subscriptions you no longer use? These realizations are the first step towards taking control of your finances. It’s like getting a detailed report showing how you’re “spending” your financial “energy” – are you efficiently powering your goals, or leaking energy (money) in unexpected places?

Creating Effective Budgets Through Expense Tracking

A budget is only as good as the information it’s based on. If you’re creating a budget without knowing where your money is currently going, you’re essentially shooting in the dark. Expense tracking provides the data you need to create a realistic and effective budget that aligns with your actual spending habits.

Instead of guessing how much you spend on groceries each month, you’ll have a precise number based on your past spending. This allows you to create a budget that reflects your true needs and priorities. You can then identify areas where you can cut back and allocate those funds towards your financial goals, whether it’s paying off debt, saving for a down payment on a house, or investing for retirement. A carefully monitored budget, backed by solid expense tracking data, is a powerful tool for financial success.

Identifying and Eliminating Wasteful Spending with Expense Tracking

One of the most significant benefits of expense tracking is its ability to expose wasteful spending habits. Often, we’re unaware of how much we’re spending on things we don’t truly need or value. These “small” expenses can quickly add up over time, draining our bank accounts and hindering our progress towards our financial goals.

For example, you might discover that you’re spending $50 a month on coffee from your favorite café. While that might not seem like much, over a year, that adds up to $600! By identifying this wasteful spending, you can make conscious choices to cut back. Perhaps you can brew your coffee at home or reduce the number of times you eat out each week. These small changes can have a significant impact on your finances over time. Think of it as finding a memory-hogging app on your phone (taking up valuable gb) and uninstalling it – suddenly, you have more space (money) to use for what truly matters.

Achieving Financial Goals with the Power of Expense Tracking

Ultimately, expense tracking is a tool that empowers you to achieve your financial goals. Whether you want to pay off debt, save for a down payment on a house, invest for retirement, or simply have more financial security, tracking your expenses can help you get there.

By providing you with a clear picture of your financial situation, expense tracking allows you to make informed decisions about your money. You can identify areas where you can save money, create a budget that aligns with your goals, and track your progress over time. This increased awareness and control can be incredibly motivating, helping you stay on track and achieve your financial dreams. It’s like having a GPS for your financial journey, constantly showing you where you are and guiding you towards your destination.