Building a secure financial future might seem daunting, but it doesn’t have to be. It’s about laying a solid financial foundation – a base of good habits and smart choices that will support your financial goals for years to come. Think of it as building a house; you wouldn’t start with the roof, would you? You’d begin with a strong foundation to ensure the structure can withstand any storm. This article provides straightforward, actionable steps you can take today to establish that sturdy financial foundation for yourself and your family.

Key Takeaways:

- Creating a budget is crucial to understand where your money goes and identify areas for saving.

- Paying off high-interest debt, like credit card debt, should be a top priority.

- Start investing early, even with small amounts, to take advantage of compounding returns.

- Automating your savings and bill payments helps ensure consistency and avoids late fees.

Mastering Budgeting for a Solid Financial Foundation

The cornerstone of any solid financial foundation is a well-managed budget. Many people shy away from budgeting, thinking it’s restrictive. However, a budget isn’t about deprivation; it’s about control. It’s about understanding where your money is going and making conscious decisions about how you want to allocate it.

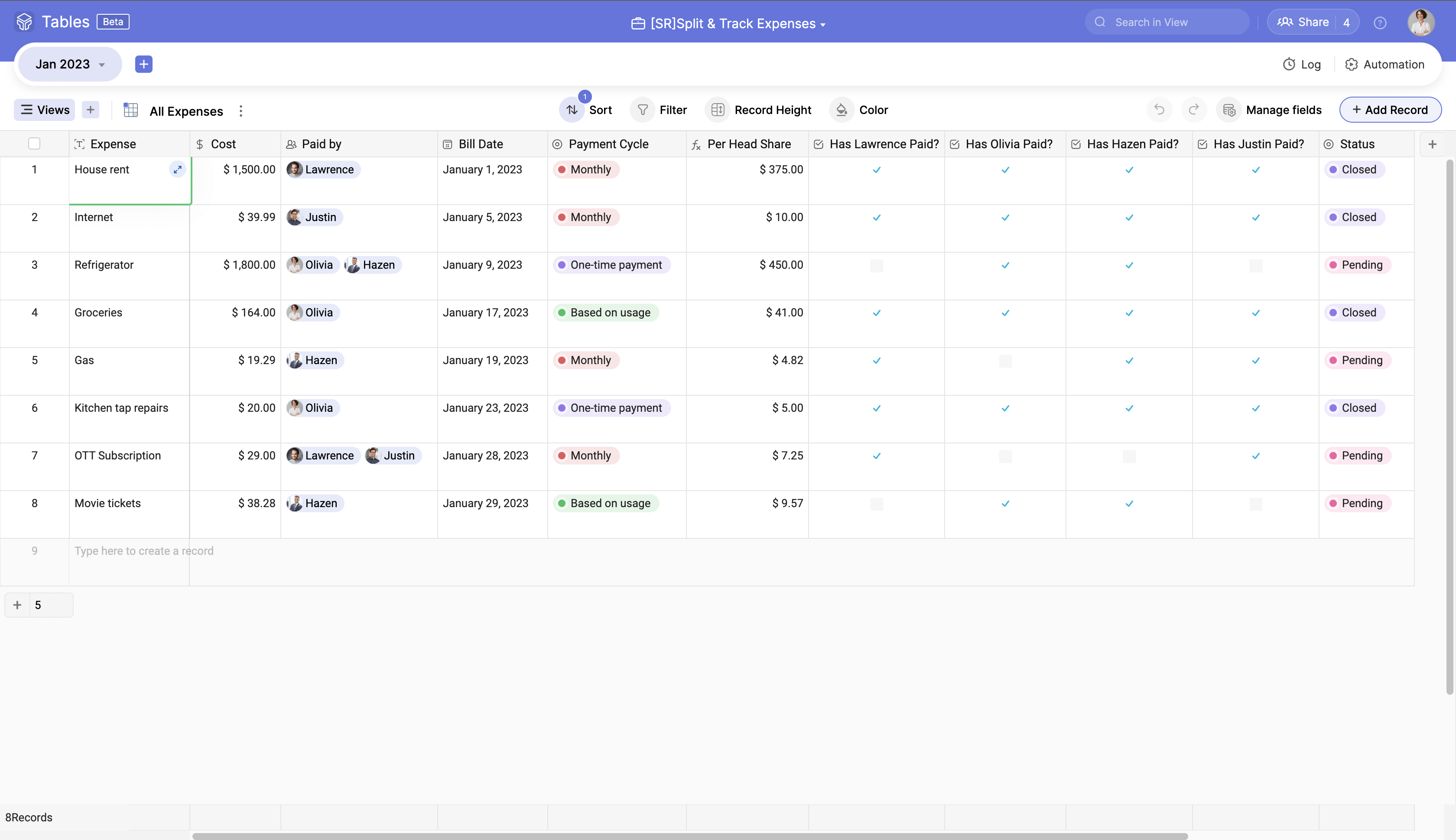

Start by tracking your spending for a month. You can use a notebook, a spreadsheet, or a budgeting app – whatever works best for you. Categorize your expenses into needs (housing, food, transportation) and wants (entertainment, dining out, subscriptions). Once you have a clear picture of your spending habits, you can begin to create a budget.

Allocate your income to different categories based on your priorities. Be realistic and flexible. Remember, the goal isn’t to eliminate all enjoyment from your life, but to spend intentionally. A popular budgeting method is the 50/30/20 rule: 50% of your income goes to needs, 30% to wants, and 20% to savings and debt repayment. Adjust the percentages to fit your individual circumstances. Review your budget regularly and make adjustments as needed. Life changes, and your budget should adapt accordingly. For those interested in gaining a basic understanding of investment strategies, consider a free course from online resources like gb sites.

Conquering Debt to Strengthen Your Financial Foundation

Debt can be a major obstacle to building a strong financial foundation. High-interest debt, such as credit card debt, can quickly spiral out of control, eating away at your income and preventing you from saving and investing. Prioritize paying off high-interest debt as quickly as possible. The avalanche method involves paying off the debt with the highest interest rate first, while the snowball method involves paying off the smallest debt first, regardless of interest rate. Choose the method that motivates you the most.

Negotiate with your creditors to lower your interest rates or consolidate your debt into a lower-interest loan. Avoid taking on new debt unless absolutely necessary. Consider strategies like the debt snowball or debt avalanche method to stay motivated. Remember, every dollar you put towards debt repayment is a dollar you can’t use for saving or investing. Reducing your debt burden frees up cash flow and strengthens your overall financial position.

Saving Strategically for a Secure Financial Foundation

Saving is another essential element of a solid financial foundation. An emergency fund is crucial for covering unexpected expenses, such as medical bills or car repairs. Aim to save three to six months’ worth of living expenses in a readily accessible account, such as a savings account or money market account.

Automate your savings by setting up regular transfers from your checking account to your savings account. Treat savings like a bill that you pay yourself each month. Consider setting up separate savings accounts for different goals, such as a down payment on a house, a vacation, or retirement. This can help you stay focused and motivated. Make saving a habit, and watch your financial foundation grow stronger over time.

Investing Wisely for Long-Term Financial Foundation

Investing is crucial for building long-term wealth and securing your financial foundation for the future. Start investing early, even with small amounts, to take advantage of the power of compounding. Compounding is the process of earning returns on your initial investment as well as on the accumulated interest.

Consider investing in a diversified portfolio of stocks, bonds, and mutual funds. Diversification helps to reduce risk by spreading your investments across different asset classes. Take advantage of tax-advantaged retirement accounts, such as 401(k)s and IRAs. These accounts offer tax benefits that can help you grow your wealth faster. If you are new to investing, it’s best to start with safe options. Educate yourself about different investment strategies and consider working with a financial advisor to create a personalized investment plan. Investing wisely is a key ingredient in building a secure and prosperous financial foundation.