Do you ever feel a knot in your stomach when you think about money? Does the thought of checking your bank account fill you with dread? You’re not alone. Many people struggle with feelings of anxiety and uncertainty when it comes to their finances. But it doesn’t have to be this way. Building financial confidence and gaining control over your money is achievable with the right knowledge and strategies.

Key Takeaways:

- Building financial confidence requires a proactive approach, starting with understanding your current financial situation.

- Creating a budget and managing debt are crucial steps in gaining control and reducing financial stress.

- Investing, even with small amounts, can build long-term wealth and contribute to financial confidence.

- Continuously learning about personal finance is essential for making informed decisions and maintaining control.

Understanding Your Starting Point to Build Financial Confidence

The first step towards building financial confidence is understanding your current financial situation. You can’t effectively plan for the future without knowing where you stand today. This involves taking a detailed look at your income, expenses, assets, and liabilities.

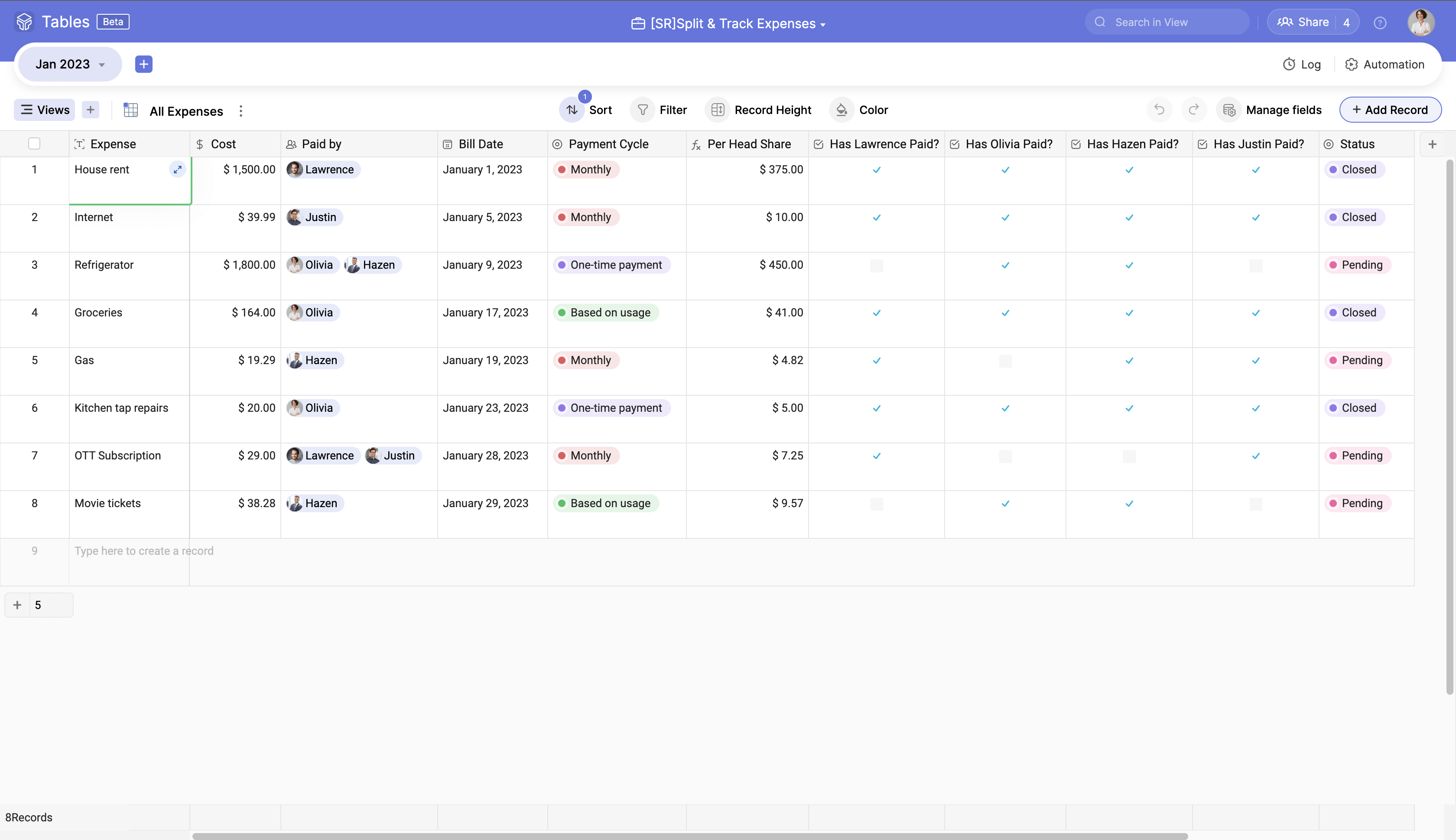

Start by tracking your income. This includes your salary, any side hustle income, investment income, and any other sources of revenue. Be as accurate as possible. Next, meticulously track your expenses. This can be done using budgeting apps, spreadsheets, or even a simple notebook. Categorize your expenses into fixed costs (rent/mortgage, utilities, loan payments) and variable costs (groceries, entertainment, dining out).

Once you have a clear picture of your income and expenses, calculate your net worth. This is the difference between your assets (what you own, such as savings, investments, and property) and your liabilities (what you owe, such as loans and credit card debt). Knowing your net worth provides a benchmark for measuring your progress as you work towards your financial goals. Don’t be discouraged if your net worth isn’t where you want it to be. The important thing is to understand your current position and start taking steps to improve it. Also, remember to check if you have any unclaimed assets, like lost pension schemes in the UK, which could potentially boost your finances. Many people may have gb pounds sitting in accounts they’ve forgotten about.

Creating a Budget and Managing Debt to Improve Financial Confidence

Creating a budget is essential for gaining control over your finances and building financial confidence. A budget is simply a plan for how you will spend your money. It helps you prioritize your spending, identify areas where you can cut back, and allocate funds towards your financial goals.

There are many different budgeting methods you can choose from, such as the 50/30/20 rule (allocating 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment) or the zero-based budget (allocating every dollar of your income to a specific purpose). Experiment with different methods to find one that works best for you and your lifestyle. The important thing is to be consistent with your budgeting and track your progress regularly.

Managing debt is another crucial aspect of building financial confidence. High-interest debt, such as credit card debt, can quickly spiral out of control and erode your financial well-being. Develop a strategy for paying down your debt, starting with the highest-interest debts first. Consider consolidating your debt into a lower-interest loan or balance transfer credit card. Be proactive in managing your debt and avoid accumulating more debt than you can comfortably repay.

Investing for the Future and Boost Financial Confidence

Investing is essential for building long-term wealth and achieving your financial goals. While it may seem intimidating, investing doesn’t have to be complicated or require a lot of money. Even small, consistent investments can make a big difference over time.

Start by educating yourself about different investment options, such as stocks, bonds, mutual funds, and exchange-traded funds (ETFs). Understand the risks and potential returns associated with each type of investment. Consider opening a brokerage account or contributing to a retirement account, such as a 401(k) or IRA.

If you’re new to investing, consider starting with low-cost index funds or ETFs, which offer diversification and are relatively easy to understand. You can also use robo-advisors, which provide automated investment management services based on your risk tolerance and financial goals. The key is to start investing as early as possible, even if it’s just a small amount each month. Consistency is key to long-term investment success and will greatly help financial confidence.

Continuous Learning and Growing Financial Confidence

Building financial confidence is an ongoing process that requires continuous learning and adaptation. The financial landscape is constantly evolving, so it’s important to stay informed about current trends, new investment opportunities, and changes in tax laws.

Take advantage of the many free resources available online, such as personal finance blogs, podcasts, and webinars. Read books on personal finance and investing. Consider taking a course or workshop on financial planning or money management. The more you learn about personal finance, the more confident you will become in making informed decisions about your money.

Surround yourself with people who are financially savvy and who can offer support and encouragement. Share your financial goals with trusted friends or family members, or consider working with a financial advisor who can provide personalized guidance and support. Remember that building financial confidence is a journey, not a destination. Be patient with yourself, celebrate your successes, and learn from your mistakes. With dedication and perseverance, you can achieve your financial goals and build a brighter financial future.